Double trouble: $FRAX and $FXS

It's been a while since we had a double token integration, but here we go again! Don't we all love when a project combines two excellent utilities into different tokens? So does Frax, bringing a new vision to create a highly, scalable, decentralized place for money into fixed-supply assets like BTC.

Here are your contract addresses for Frax ($FRAX):

ETH: 0x853d955acef822db058eb8505911ed77f175b99e

BNB: 0x90C97F71E18723b0Cf0dfa30ee176Ab653E89F40

FTM: 0xdc301622e621166BD8E82f2cA0A26c13Ad0BE355

Polygon: 0x45c32fA6DF82ead1e2EF74d17b76547EDdFaFF89

And there you go for Frax Share ($FXS):

ETH: 0x3432b6a60d23ca0dfca7761b7ab56459d9c964d0

BNB: 0xe48A3d7d0Bc88d552f730B62c006bC925eadB9eE

FTM: 0x82f8cb20c14f134fe6ebf7ac3b903b2117aafa62

Don't forget to use your digital wallet for paying for jobs, tasks, and offers on our amazing platform, HYVE!

Get to know Frax Protocol

We all know that most protocols have embraced either entirely collateralized or entirely algorithmic with no backing designs that are difficult to grow and have extreme volatility. Here's not the case - Frax is clearly the first stablecoin protocol to implement design principles of both to create a highly scalable, trustless, extremely stable, and ideologically pure on-chain money.

HYVE is not the type to do ads, but if you are keen on this project, we have found a Youtube video that explains all about Frax in under 5 minutes just for you. Click the button down below to see!

How does it work?

Instead of simply functioning as a specialized stablecoin, Frax aims to serve as a decentralized finance (DeFi) money market that makes use of several distinct mechanisms. These include minting and redeeming the FRAX stablecoin as well as staking by providing liquidity provider (LP) tokens to various trading pairs on Uniswap. The Frax crypto protocol makes use of two distinct assets: the Frax (FRAX) stablecoin, which is pegged 1:1 to the U.S. dollar, and the Frax Shares (FXS) governance and utility token.

Meet FRAX & FXS!

The Frax protocol is a two-token system encompassing a stablecoin, Frax (FRAX), and a governance token, Frax Shares (FXS).

FRAX - staying stable has never been so cool!

Getting its name from the fractional algorithmic stability mechanism, $FRAX is the first and unique stablecoin with both fractions of its supply backed by algorithmic and collateral, respectively, implying that Frax remains the first stablecoin protocol with fractions of its supply unbacked and floating respectively.

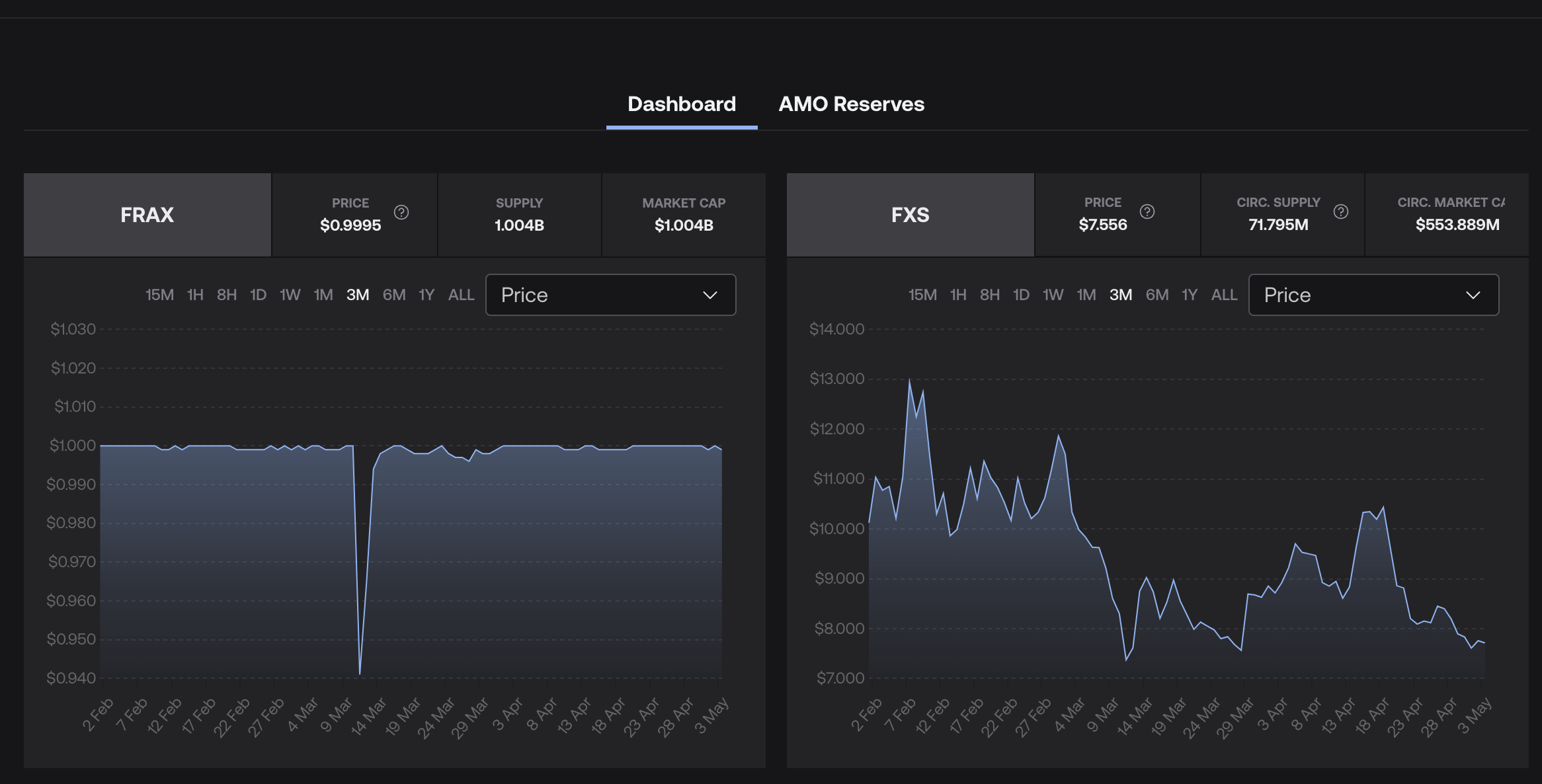

Being the protocol's native currency, $FRAX maintains a peg to the U.S. dollar by being partly collateralized by the USD coin ($USDC). The ratio of the algorithmic and collateralized solely depends on the market value of the protocol’s stablecoin $FRAX.

If FRAX is trading above $1, the protocol decreases the collateral ratio. If FRAX trades under $1, the protocol increases the collateral ratio.

FXS - time to get innovative!

Frax Share, known as $FXS, is the second token tied to $FRAX, belonging to the protocol. $FXS is the non-stable utility and governance token, also referred to as the accumulated value (value accrual) of the Frax ecosystem.

Its character permits its holders the right to vote and govern the entire Frax network, while the parameters governed by the $FXS are adjusting different fees like redeeming or minting and adding or adjusting collateral pools. Another parameter that can be determined through the $FXS voting is fixing the rate of the collateral ratio.

The protocol was designed to allow the $FXS supply to depreciate greatly with an increase in $FRAX demand, as the market cap for $FXS is calculated as the expected net value creation from the seigniorage of the $FRAX token's continuity.

In addition, the increase in the $FXS market cap enables the system to keep the $FRAX token stable. Thus the main focus of the protocol’s design is to maintain the value of the $FRAX token as a stablecoin, this being made possible by accruing a maximal value to the $FXS token.

HYVE's plans

We are actively working on improving HYVE, as it was recently brought to our attention that security is one of the main user demands when migrating from the web2 to the web3 space.

Worry not, HYVE v2.5 will have increased security, as we will be looking to onboard traditional freelancers into blockchain technology! There are many features to be enjoyed - which are you most excited about?