The global village

To this day one of the most touted arguments against the global adoption of blockchain remains the volatility of the most publicly recognized coins and tokens.

To properly assess this, we must first mention that cryptocurrency as a market, in general, is still in its infancy in many regards. At the moment of writing this, there are ~20.5 Million Bitcoin addresses and an additional ~35 Million Ethereum addresses.

As we all know, however, many crypto users have several wallets with a single hardware wallet. Regardless, let’s assume that instead, one unique address = 1 user. So assuming there are 57 Million crypto users at the moment, that means blockchain is used, at the very best, by a staggering 0.75% of the population right now. That means the real number is probably lower, so we can estimate it as 0.25–0.75% of the global population.

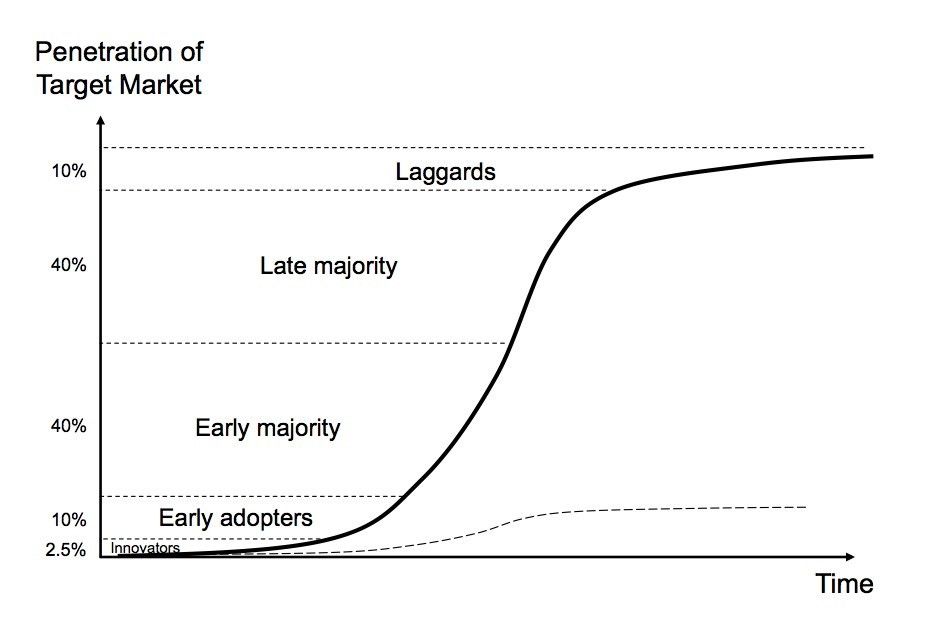

This means that on Roger’s Adoption Curve we are still during the “Innovators” stage and will continue to remain in it for at least a couple more years.

In comparison, the internet bubble took place from 1995 (0.4% adoption) to 2000 (5.8% adoption). However, the dot-com crash ended in 2002, when internet adoption was already at 9.4%.

In other words, when the dot-com crash took place, the internet was at least in terms of user adoption, 12x-35x more popular than blockchain is right now. This makes the 2019 situation of blockchain closer to the internet period of 1995–1996 (0.4–0.9% adoption rate).

Let’s go a little back, before the internet.

The Global Village theory

During the 1960s, Marshall McLuhan, a Canadian professor published The Gutenberg Galaxy describing how communication affects cognitive organization which in turn affects social interaction. McLuhan believed that print technology was the main contributor and what made possible the emergence of individualism, democracy, capitalism, and nationalism.

At the most fundamental level, they are based on a principle described in the book as “segmentation of actions and functions and the principle of visual quantification.”

“Schizophrenia may be a necessary consequence of literacy. [p. 32]”

― Marshall McLuhan, La galaxia Gutenberg

Then comes along his next book, The Global Village, predicting that electronic media will replace visual culture with aural culture, calling it “electronic interdependence”.

The Global Village then is the new social organization created by this paradigm, where a collective identity becomes the norm instead of individualism and fragmentation. A world interconnected through an electric nervous system.

About 10 years after his death, along comes the internet and most of McLuhan’s predictions become a reality. The village made one of his coined terms, “surfing”, go viral. McLuhan described it as a rapid, irregular, and multidirectional movement through a heterogeneous body of documents or knowledge.

Then we had the 90s technology boom and the consequent 2002 dot-com crash. Now let’s resume our topic of stability and apply it to the internet, which we have already concluded was more mature as technology during the bubble burst.

By the end of the stock market downturn of 2002, stocks had lost $5 trillion in market capitalization since the peak. At its trough on October 9, 2002, the NASDAQ-100 had dropped to 1,114, down 78% from its peak.

At the very minimum, just the crash itself lost 6x more monetary value than the entire market capitalization of all cryptocurrencies was worth at its all-time high. (813B — Jan 7, 2018)

Blockchain is an infant technology, found in its innovation phase and not any more volatile than traditional stock during the adoption of the last previous technological innovation, the internet.

Decentralized Village

Having established our collective identity, it would seem as if through an almost unanimous vote of this group, it has been decided that memes rule the internet and will continue to do so in the future as well.

On a more serious note, now that we’re closer than ever to becoming a borderless society, decentralization is the easiest way to achieve this.

The basis of decentralization is that blockchain technology and its first implementations were in financial services with Bitcoin opening the industry and Ethereum starting the race of innovation for startups.

Both of these tokens, however, are still very volatile. So while Bitcoin has offered market assessment and Ethereum offers a layer for developers to build on, neither could be used as part of a service that requires day-to-day transactions at fixed values. At least for now.

Enter stablecoins, a term that gained popularity after the introduction of Tether, even though Tether lost popularity as time passed and the industry progressed. Stablecoins maintain a specific value (for example 1$) and are therefore ideal for payments.

Are non-volatile tokens a conspiracy theory?

Some stablecoins are more stable than international currencies like USD, GDP, or EUR. Let’s take DAI as an example. Dai is part of a two token system, DAI, and MKR. 1 DAI = 1$ whereas MKR is a volatile token. DAI remains at 1$ as the result of a collateral system and price feeds.

When you buy DAI it’s more like taking a loan, where you use your ETH as collateral and the bank is the autonomous system that governs DAI. If the ETH price changes the system will sell your ETH to the highest bidder.

The entire system is much more complex than this and can be considered one of the most creative systems out there on blockchain right now, so if you want to learn more about it, check out the website.

Maker is a DAO (Decentralized Autonomous Organization), but there are other types of stablecoins as well, take DGX or USDC for example.

DGX is backed by real gold through a process called Proof of Asset (PoA). You need to record the possession of an asset on the Ethereum blockchain through what is called an Asset Card. DGX tokens are generated by a smart contract that receives PoA cards and generated tokens for each gram of gold.

Then there’s the newest of the bunch, USDC, the stablecoin created by Circle and the only one that’s being traded on Coinbase. USDC is in essence very similar to Tether but with a more transparent approach. It’s fully compliant with regulations and it’s an ERC20 token that can be checked by anyone.

Decentralized Freelancing, Stablecoins, and HYVE

Among other industries that will be affected by blockchain technology, the workforce industry remains at the top for most disruptive opportunities, and the issue of payments was and still is one of the many concerns when discussing a decentralized freelancing platform.

That’s where stablecoins come in because they allow for a traditional exchange of goods-for-services in a trustless and borderless manner without all the hassle.

After all, the user should have the option to assume risks on a task paid in a volatile token, whether it’s because he believes in the project, needs experience, or simply felt like it.

Choosing to complete tasks in a volatile token might end up badly if we look at it from today’s perspective, and that’s because there are a lot of companies going out of business every day. However, as the market progresses and blockchain startups mature volatility will decrease and therefore the increases or drops in price will not result in life-changing events.

This, in turn, will enable the everyday freelancer to make small “investments” in companies he considers valuable over time. Say in a year you complete 80% of projects in stablecoins and 20% in native tokens of companies you can get behind.

While the increases are not significant, if they are constant, or in other words, if you HODL, then those increases start to compound over time.

🐝 Want to learn more about HYVE?

🐦 Follow us on Twitter.

🗨️ Join our Telegram Group.

📢 Join our Announcement Channel.

💡 Visit our Website.

💡 Join our Discord.

👍 Like us on Facebook.

✅ Follow us on Instagram.